We had a question from Sandy asking if we could explain the Mil Levy as it pertains to everyone’s taxes. Here is some of what the state of Nebraska says and we will put links to all this information at the bottom of this post so you can check as well.

Mil Levy. First Mil is Latin for 1000. So it is the rate at which a county or taxing entity (subdivision) taxes you per $1000 dollars of value on your property.

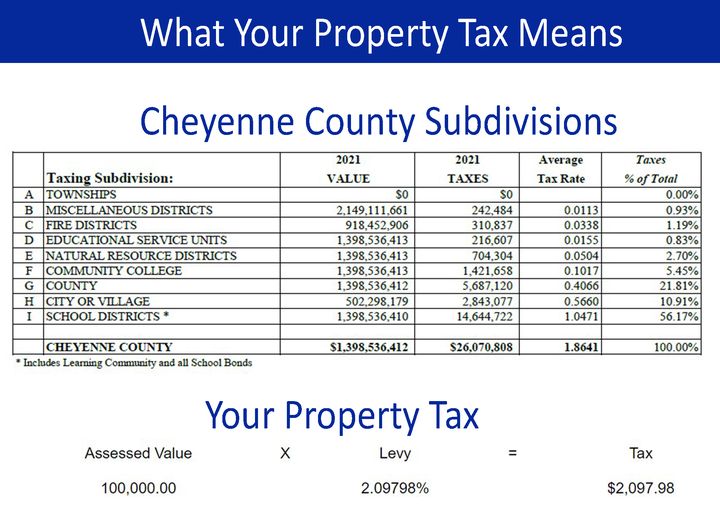

So in the example which is provided by Douglas County if your home is worth $100,000. Douglas County mil rate is 2.09798. Then the property tax would be $100,000 X 2.09798% which equals $2,097.98. So about 2% is the tax rate on the value of your home. Or if you look at it with Mil Value it is 2.09 per $1,000. Or $2.09 per $1,000 of value. Kinda confusing! Just remember that the percent sign is very important or remember that the mil rate is per $1,000 of value.

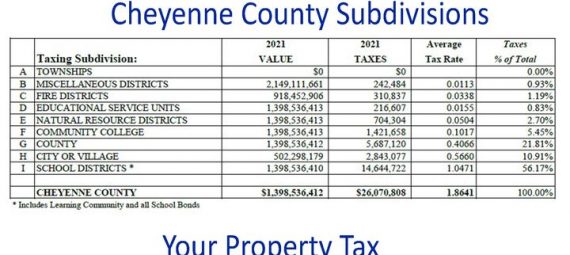

You will also see the Subdivisions for Cheyenne County as reported by the Nebraska Department of Revenue. Each one of these subdivisions makes a tax ( mil value) on your property.

You can see for example that Cheyenne County’s total tax rate in 2021 was 1.8641% which is the 6th highest out of the 93 counties according to the Nebraska Department of Revenue. Links to this report are below.

The state of Nebraska also limited the total amount of what subdivisions can tax. This is to help protect the taxpayers. For example, the county in the example above can not exceed a tax rate of .5, and schools are limited to 1.05. Below are links to help explain. This is presented in a very easy-to-read PDF on Nebraska taxes from the Department of Revenue. Link below.

Counties can also raise the value of your property. So they can raise the mil rate AND raise the value of your property for higher increases. In the current budget, the county is asking for an 8% total raise in taxes. 4% from home value and 4% from mil value.

This will impact fixed-income residents the hardest.

Nebraska Department of Revenue

Cheyenne compared to other counties

Basics of Nebraska Taxes and Mil Value Limits

How to Calculate Property Taxes, Douglas County