Have you checked your latest taxes everyone?

Here is what happened to us, when we questioned our taxes assessment in Melody Keller’s office on July 6th of this year.

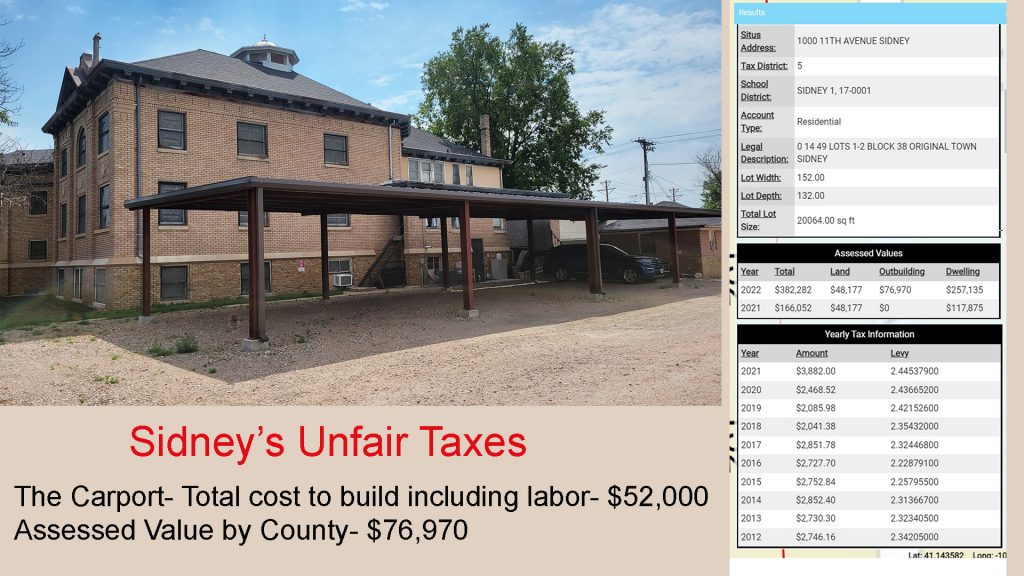

She told us at that time our new carport would be valued at “replacement” costs which were $52,000, which is the total cost to build it including labor from a local contractor. I said the national average for carport valuation in the USA is 80% of the cost. So we should be around $40,000. Nope, she got angry, and said she was not done. Now, we see. She valued a carport that took $52,000 to build with a permit she had in her office at $76,970. So the national average is 80% but in Sidney, if you complain it is 148%. WOW. And it looks like the carport ADDED even more value to our building because it more than doubled in value!!! WOW. Don’t build in Sidney!!!!

Oh, one last thing… All 3 County Commissioners Darrell Johnson, Randal Miller, and Philip Sanders signed off on this increase. Does this just feel wrong?

Small town values… Big time taxes! Hope these people are able to be recalled. It’s all the rage right now! 🙂

Yes, that is exactly why we went to Sterling 4 years ago. Our taxes went up so high and we got nowhere with the residents of Sidney. Good luck! We will be following this closely!

We added an “old” chicken coop (instead of buying new or building a new one, doesn’t even have a concrete pad underneath) and they assessed it at $1520 and raised our taxes $4K. On Melody’s assessment of her home it added an outbuilding (assessed at $3125) and it DECREASED her taxes by $11375.